Small and medium-sized enterprises (SMEs) are the backbone of the economy, but they are also prime targets for cybercriminals. With limited resources and fewer cybersecurity defenses, SMEs face a growing threat from cyber fraud.

The financial outcomes can be devastating, with the average cyberattack costing SMEs $200,000, forcing many to shut down within months of a breach.

This raises an important question: Is cyber fraud warranty coverage a cost-effective solution for SMEs? Many business owners hesitate to invest in cybersecurity warranties, assuming they are an unnecessary expense. However, when compared to the financial and reputational risks of cyber fraud, the right coverage can actually save a business from crippling losses.

Let’s break down the true value of cyber fraud warranty coverage and how SMEs can benefit.

The True Cost of Cyber Fraud for SMEs

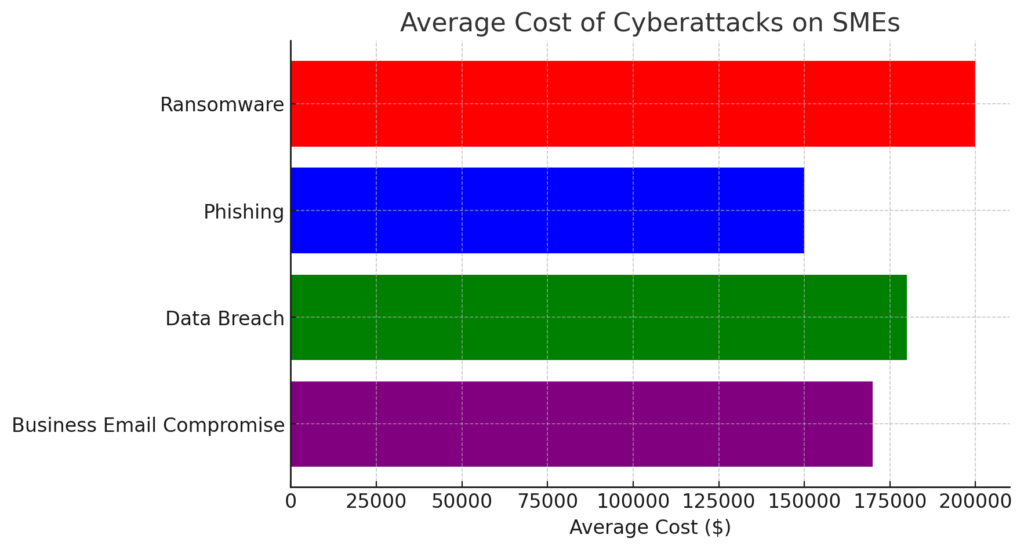

Before evaluating the cost-effectiveness of cyber fraud warranty coverage, it’s crucial to understand the financial damage cyber fraud can cause. Cybercriminals use various methods, including phishing scams, ransomware attacks, and fraudulent transactions, to steal money and sensitive data.

1. Financial Losses

SMEs often don’t have the cash reserves to recover from cyber fraud. A ransomware attack or data breach can result in:

- Direct financial theft through fraudulent transactions.

- Loss of customer payments due to compromised accounts.

- Expensive legal fees to address lawsuits and compliance violations.

2. Business Downtime and Operational Costs

Many cyberattacks lead to extended downtime, which means businesses can’t serve their customers. This results in:

- Lost sales and revenue.

- Additional expenses to restore systems and secure data.

- Compensation costs if customer information is leaked.

3. Reputation Damage and Customer Trust

A cyber fraud incident doesn’t just impact finances—it can permanently damage customer trust. Studies show that 60% of consumers stop doing business with companies after a data breach. This means losing not just immediate sales but long-term customers who no longer feel safe sharing their data.

How Cyber Fraud Warranty Coverage Protects SMEs

Cyber fraud warranty coverage acts as a financial and security safety net, helping businesses recover from cyber fraud without facing severe financial strain. Unlike traditional cybersecurity measures that focus only on prevention, warranty coverage provides financial assistance, expert support, and recovery solutions if an attack occurs.

1. Financial Compensation for Cyber Losses

One of the biggest benefits of cyber fraud warranty coverage is financial reimbursement. If an SME falls victim to cyber fraud, the warranty helps cover:

- Stolen funds due to fraudulent transactions.

- Ransom payments (if necessary) to restore access to critical data.

- Costs associated with legal defense and regulatory penalties.

This reduces the financial burden on the business, allowing them to focus on recovery rather than scrambling to find funds.

2. Expert Incident Response and Support

Most SMEs don’t have an in-house cybersecurity team. Cyber fraud warranty coverage often includes 24/7 incident response services, providing immediate support when an attack happens. This includes:

- Threat containment to prevent further damage.

- Digital forensics to track how the fraud occurred.

- Data recovery services to restore stolen or lost information.

Having access to cybersecurity professionals without the cost of hiring a full-time team makes cyber fraud warranty coverage a cost-effective investment.

3. Legal and Regulatory Compliance Assistance

Many SMEs don’t realize that a cyber fraud incident can lead to legal and regulatory consequences. GDPR and CCPA data protection laws require businesses to report breaches, and failure to do so can result in heavy fines. Warranty coverage helps SMEs:

- Understand legal requirements and report breaches properly.

- Cover legal fees associated with cyber fraud cases.

- Ensure compliance with data security laws to avoid penalties.

By including legal support, warranty coverage saves SMEs thousands in potential fines and legal expenses.

4. Reputation Management and Customer Assurance

Rebuilding customer trust after a cyber fraud incident is difficult, but cyber fraud warranty coverage helps businesses recover faster. Many coverage plans include:

- Public relations support to manage the company’s reputation.

- Credit monitoring services for affected customers.

- Guidance on strengthening security to prevent future attacks.

This not only minimizes damage to the brand but also reassures customers that the business is taking cybersecurity seriously.

Is Cyber Fraud Warranty Coverage Cost-Effective for SMEs?

The cost of cyber fraud warranty coverage depends on factors like business size, industry, and the level of coverage chosen. However, when comparing costs, businesses should consider:

- Potential losses vs. coverage cost – The price of warranty coverage is significantly lower than the financial losses caused by a cyberattack.

- Cybersecurity investment vs. in-house expenses – Hiring cybersecurity experts or recovering from an attack can be far more expensive than paying for affordable, ongoing coverage.

- Reputation recovery – The long-term impact of losing customer trust can’t be measured in numbers, but warranty coverage helps businesses rebuild credibility faster.

For most SMEs, investing in cyber fraud warranty coverage is a cost-effective way to mitigate risk, ensure financial stability, and protect business continuity.

Conclusion

Cyber fraud is no longer a rare event—it’s a growing risk that SMEs can’t afford to ignore. Cyber fraud warranty coverage offers a practical, affordable solution that ensures businesses don’t bear the full burden of an attack.

By providing financial protection, expert support, legal assistance, and reputation management, cyber fraud warranty coverage is a smart investment.

Also Read: How Can Businesses Leverage a Warranty Against Ransomware for Greater Security?