The orders were lined up, payments were being processed, and everything was moving smoothly. Then, the screen flickered. The first email arrived: “Your files have been encrypted.” At first, it seemed like a glitch. Employees tried refreshing their browsers, restarting their computers—but the message remained. And then, more emails followed.

Within minutes, operations ground to a halt.

Customer service calls surged with complaints about missing shipments, payroll was frozen, and vendors started asking questions. In the conference room, executives stared at a ransom demand: “$500,000 in Bitcoin, or your data is gone.”

The team scrambled. IT called their cyber insurance provider, hoping for immediate help. But instead of relief, they were met with red tape: “Submit your documentation. The claims process will take several weeks.”

Weeks? The company didn’t have weeks. It barely had hours before financial losses spiraled out of control.

The Illusion of Protection: Why Cyber Insurance Fails in Real Time

Cyber insurance was supposed to be a lifeline. Businesses had been assured that if an attack happened, they’d be covered. But ransomware doesn’t wait for paperwork. It doesn’t pause while claims are reviewed.

Traditional cyber insurance operates like a reimbursement program, meaning businesses must pay upfront for forensic investigations, legal fees, and even ransom negotiations—all before seeing a single cent from their insurer. And if they make a mistake in their claim? Denied.

Meanwhile, every minute of downtime costs thousands. Customers lose trust. Competitors move in. And in the worst cases, companies never fully recover.

Read more: Downtime Costs World’s Largest Companies $400 Billion a Year, According to Splunk Report

Cyber Warranties: A Different Kind of Protection

A cyber warranty doesn’t just promise financial aid—it delivers immediate action. It’s not about filing claims and waiting for approval. It’s about stopping ransomware in its tracks and ensuring businesses have the funds they need—right away.

When an attack happens, businesses covered by a ransomware coverage don’t need to beg their insurer for help. Instead, they get instant financial support to cover recovery costs.

Cyber warranties integrate with security systems, continuously monitoring for threats, and when an attack happens, businesses are covered without delay.

The Cloud Security Myth: Why O365 and Google Workspace Users Are Still at Risk

Many companies assume that because they use Microsoft 365 or Google Workspace, they’re protected. After all, these are cloud-based platforms with built-in security, right? Wrong.

While these platforms secure their infrastructure, they do not protect businesses from:

- Phishing attacks that steal login credentials

- Insider threats where employees mistakenly delete or expose sensitive data

- Ransomware infections that encrypt cloud-stored files and demand payment for their release

Businesses often learn this the hard way, realizing too late that Microsoft isn’t responsible for data recovery. With a ransomware coverage in place, however, the business would already have a safety net—one that provides immediate financial coverage and security solutions that cloud providers don’t.

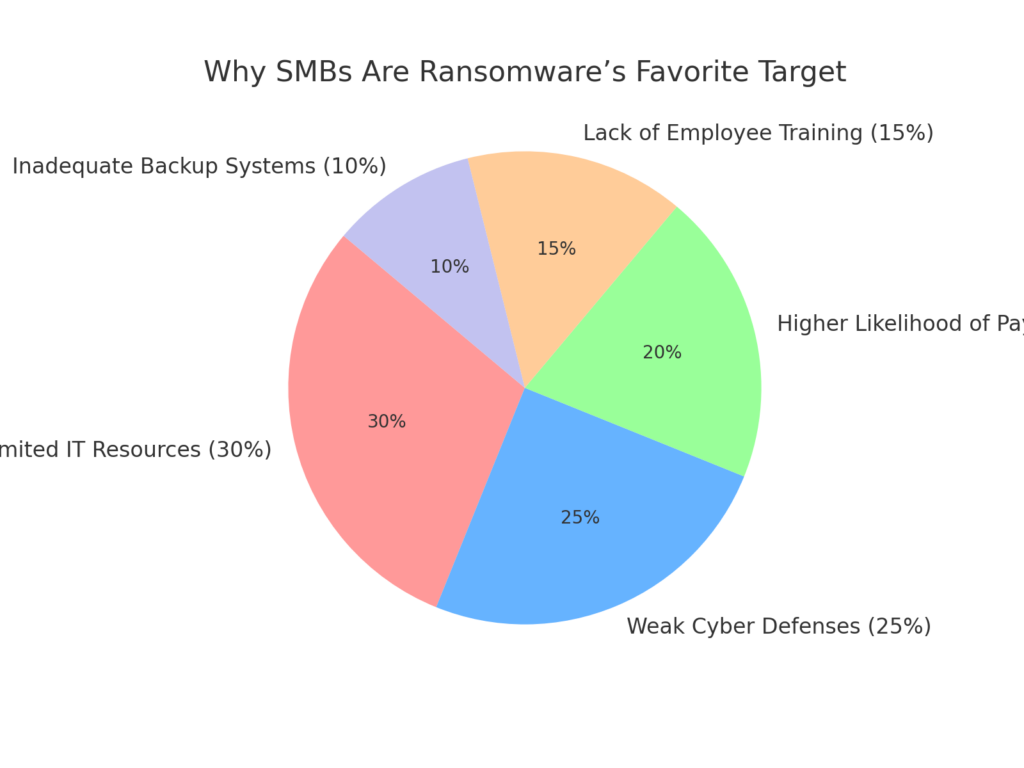

Why SMBs Are Ransomware’s Favorite Target

Large corporations grab headlines when they suffer attacks, but small and mid-sized businesses (SMBs) are the real targets. Hackers know that:

- SMBs often lack dedicated cybersecurity teams

- Cyber insurance providers are rejecting more claims and increasing costs

- A single attack can force an SMB to close permanently

Traditional cyber insurance is becoming increasingly unaffordable for SMBs, leaving them with two choices: risk it all or find a smarter alternative.

A ransomware coverage bridges this gap. It’s affordable, tailored for SMBs, and offers protection where insurance fails.

Even better, businesses that maintain a clean security track record with cyber warranties can later use that history to secure better insurance rates and approvals in the future.

Conclusion

The company in our story never saw the attack coming—but they could have been prepared. If they had a cyber warranty, they wouldn’t have been stuck waiting for an insurer’s decision.

They would have had the resources to act immediately, paying for recovery, securing expert assistance, and restoring operations without crippling financial losses.

Ransomware is evolving. Cybersecurity strategies must evolve too. Cyber warranties offer a modern, rapid-response approach, ensuring that when ransomware strikes, businesses don’t just survive—they recover faster, stronger, and with minimal damage.

Because in today’s cyber battlefield, waiting isn’t an option.

Also Read: How Does a Cyber Data Warranty Provide Peace of Mind in Today’s Digital Age?