The attack was swift, silent, and devastating. A small business, believing its cloud applications and antivirus were enough to keep hackers at bay, suddenly found itself locked out of its own systems. Customers’ data was at risk, operations ground to a halt, and the damage was mounting by the second.

The business owner rushed to file a claim with their cyber insurance provider. But what followed was a frustrating cycle of paperwork, delays, and unexpected exclusions. The insurer requested forensic reports, compliance evidence, and proof that the company had taken “reasonable precautions”—a term so vague that the claim was eventually denied.

For many businesses, this is the dark side of cyber insurance. While it’s designed to offer financial relief, it does nothing to actively prevent cyberattacks in the first place. That’s why companies are now turning to a more proactive solution: cyber fraud warranty coverage.

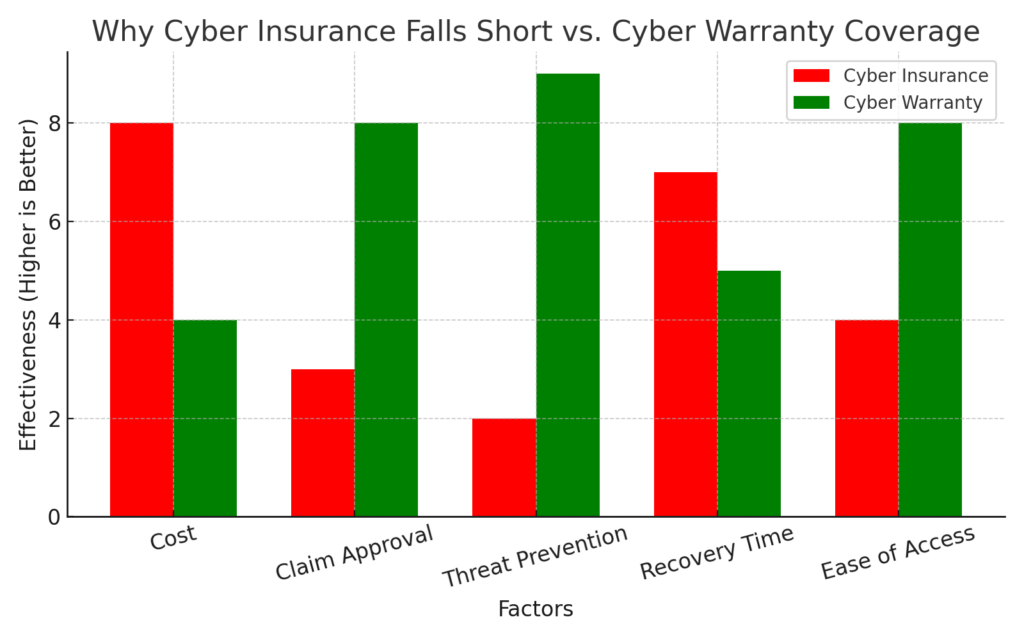

Why Cyber Insurance Falls Short

Cyber insurance was once seen as the ultimate safety net, but today, it’s becoming more difficult to obtain, expensive to maintain, and unreliable when needed the most.

- Premiums are rising. With cyberattacks growing in scale and sophistication, insurers are tightening their policies and raising costs.

- Claims are often denied. Many businesses don’t meet strict security requirements, leading to rejected claims.

- It doesn’t stop cyber threats. Insurance provides financial compensation after an attack, but it doesn’t actually protect systems.

- Long recovery periods hurt businesses. Even if an insurance payout is approved, companies still face weeks or months of downtime and reputational damage.

For SMBs, these challenges make cyber insurance a reactive tool, not a preventative one.

Cyber Warranties: A Smarter Approach to Security

Cyber fraud warranty coverage isn’t just an alternative to cyber insurance—it’s a smarter, proactive defense mechanism. Instead of focusing only on financial recovery, cyber warranties work to prevent attacks before they happen.

One of the biggest misconceptions among SMBs is that Microsoft 365 (O365) and Google Workspace (G-Suite) provide full security just because they operate in the cloud. But cloud security does not protect endpoints—the devices employees use daily, which are more common targets.

This leaves a dangerous gap in security, one that cybercriminals are quick to exploit. A cyber warranty fills that gap.

Cyber fraud warranty coverage ensures businesses are actively defended with:

- Endpoint security solutions that protect devices beyond cloud applications.

- Proactive monitoring to detect and act on threats before they cause damage.

- Real-time threat response to stop ransomware and phishing attempts.

- Financial protection if an attack does slip through, ensuring a quick recovery.

Rather than waiting for an attack to happen, cyber warranties prevent them from occurring in the first place.

A Bridge to Better Cyber Insurance

Many SMBs struggle to obtain affordable cyber insurance due to limited security measures. But what if businesses could prove they were already well-protected?

Cyber fraud warranty coverage creates a history of strong cybersecurity practices, making it easier for businesses to qualify for cyber insurance in the future. Insurers look favorably on companies that can demonstrate:

- A track record of cybersecurity compliance

- Strong security defenses that reduce risk

- Fewer previous claims, showing proactive protection

By investing in a cyber warranty, SMBs not only protect themselves today but also position themselves as better candidates for cyber insurance tomorrow.

Conclusion

Cyber threats evolve daily. Businesses can no longer take the risk of relying on outdated, reactive solutions that only provide compensation after an attack has already occurred.

Cyber fraud warranty coverage is a modern, intelligent approach to security—one that doesn’t just promise financial recovery but actively prevents cyberattacks from disrupting businesses.

Because in cybersecurity, the best protection isn’t about waiting for an attack to happen—it’s about making sure it never happens at all.

Also Read: Protect Your Enterprise: DLT’s Strategic Role in Ransomware Defense