With cyber threats becoming more advanced, businesses are looking for ways to protect themselves from financial and operational damage. Many companies rely on cyber insurance, believing it will fully cover them in case of an attack.

But there’s a new player in cybersecurity protection that businesses are quickly turning to—cyber warranties. Unlike cyber insurance, which primarily helps businesses recover after an attack, cyber warranties offer proactive protection with financial safety nets.

How Cyber Insurance Works

Cyber insurance is designed to mitigate financial losses after a breach, covering expenses such as forensic investigations, legal fees, regulatory fines, and ransomware payments. However, it comes with significant limitations that businesses often overlook.

One of the biggest challenges with cyber insurance is the slow claims process. Insurance providers require businesses to prove compliance with strict security measures, and claims can take months to be approved. Even then, insurers frequently deny claims due to technicalities or failure to meet policy conditions.

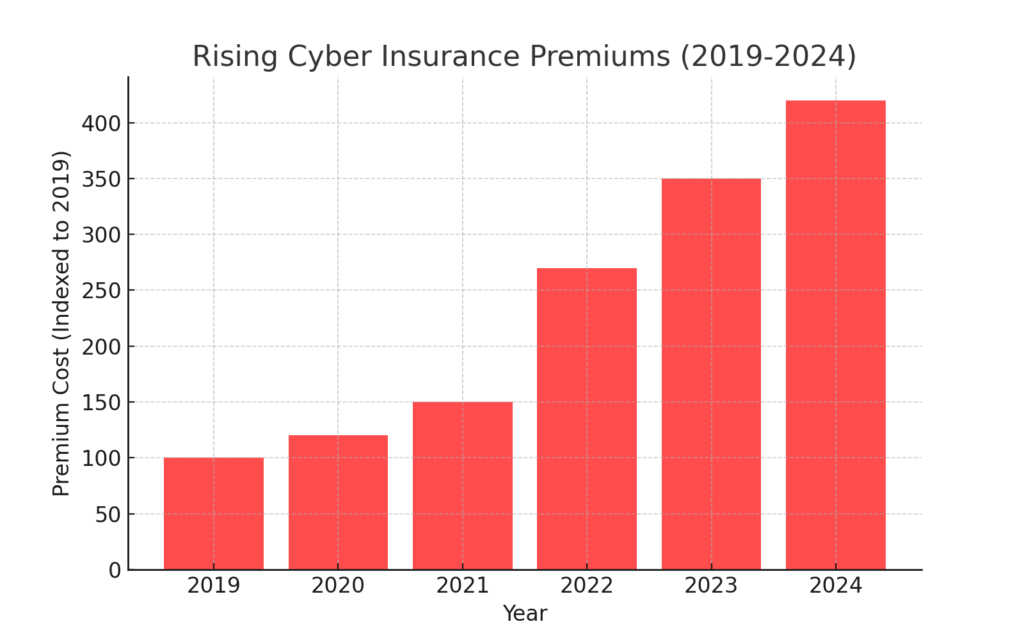

Another issue is the rising cost of premiums. The global surge in cyberattacks has led to higher insurance rates, making it difficult for small and medium-sized businesses (SMBs) to afford coverage. Additionally, most cyber insurance policies exclude incidents caused by human error, leaving companies vulnerable to one of the most common causes of cyber breaches.

Rising Cyber Insurance Premiums (2019-2024)

The cost of cyber insurance has skyrocketed due to the increasing frequency and severity of cyberattacks.

According to industry reports, cyber insurance premiums increased by over 79% in 2022 alone, and this trend continues. Businesses now face higher costs for less coverage, making cyber insurance an unreliable safety net.

Cyber Warranties: A More Proactive Approach

Cyber warranties provide immediate financial compensation when security measures fail, rather than requiring businesses to file claims after an incident. They integrate directly with cybersecurity tools like Microsoft Defender and O365, continuously monitoring threats and ensuring businesses remain protected.

One of the key advantages of a cyber warranty company is its focus on risk prevention. Instead of simply offering reimbursement after an attack, cyber warranties help businesses detect and address vulnerabilities in real-time.

Unlike cyber insurance, which often has complex underwriting and exclusions, cyber warranties are affordable, straightforward, and tailored to modern cybersecurity needs. Businesses can access instant payouts without the hassle of drawn-out claim processes, ensuring they stay operational even in the face of an attack.

Cyber Warranty vs. Cyber Insurance – Key Differences

Cyber Warranty vs. Cyber Insurance

| Feature | Cyber Warranty | Cyber Insurance |

| Purpose | Preventive financial protection for cyber incidents | Reactive coverage for losses after an attack |

| Coverage Type | Covers security failures that bypass protections | Covers financial losses due to cyber incidents |

| Payout Speed | Immediate payout upon breach detection | Claims process can take weeks or months |

| Focus | Encourages proactive cybersecurity measures | Focuses on damage compensation after an attack |

| Risk Mitigation | Integrated with cybersecurity tools for real-time risk reduction | May require compliance with security policies but does not actively prevent attacks |

| Who Benefits? | Businesses looking to strengthen security & reduce out-of-pocket losses | Businesses needing financial recovery after a cyber event |

| Cost Structure | Fixed-cost model with predictable pricing | Premium-based, subject to change with risk factors |

The Problem with Relying Solely on Microsoft 365 & Windows Defender

Many businesses assume that Microsoft handles all aspects of data security within O365. While Microsoft offers a robust infrastructure, it follows a shared responsibility model, meaning businesses must take additional steps to protect their data.

Similarly, while Windows Defender is a strong antivirus solution, it should be part of a broader cybersecurity strategy that includes firewalls, endpoint protection, and backup solutions. Businesses that rely only on these built-in tools expose themselves to significant risks.

Top Misconceptions About Microsoft 365 & Windows Defender

- “Microsoft 365 automatically backs up our data.” → False. Microsoft ensures platform availability, but users must back up their data to prevent loss from accidental deletion or ransomware attacks.

- “Windows Defender is enough to keep us secure.” → Not entirely. While Defender provides good baseline protection, it should be complemented with additional threat detection tools.

- “Cloud storage is more vulnerable than on-premises storage.” → Incorrect. Cloud providers like Microsoft implement advanced security controls, but misconfigurations can still expose businesses to risks.

- “Cyber insurance will cover all our losses.” → Untrue. Insurance policies have exclusions, high deductibles, and long claim processes, making full coverage unlikely.

Why SMBs Should Consider Cyber Warranties Over Cyber Insurance

For SMBs, cyber warranties provide a more practical and cost-effective solution. With cyber insurance becoming harder to obtain and more expensive, businesses need a faster, simpler way to stay protected.

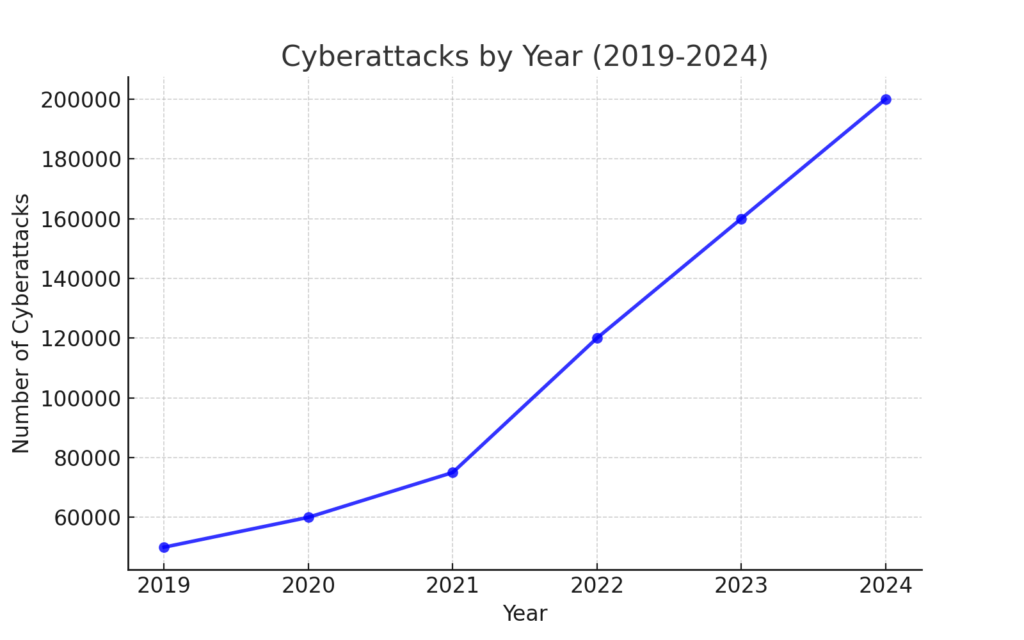

The number of cyberattacks has increased by over 67% in the past five years, making proactive security essential. Cyber warranties eliminate the waiting period for compensation, allowing businesses to recover immediately.

Cyberattacks by Year (2019-2024)

With cyber threats rising exponentially, businesses can’t afford to wait for slow insurance claims. Cyber warranties provide a faster, more efficient way to manage cyber risks.

The Future of Cyber Protection: Warranties Are Leading the Way

As cyberattacks become more frequent and sophisticated, businesses must move beyond traditional insurance. Cyber warranties offer real-time risk detection, seamless integration with cybersecurity tools, and instant financial protection—making them the smarter choice for modern businesses.

A cyber warranty company like DLT Alert ensures businesses don’t just respond to cyber incidents—they actively prevent them. While cyber insurance is reactive, cyber warranties focus on proactive risk management, giving businesses the protection they need before an attack happens.

With cyber insurance premiums rising, claims being denied, and cyber threats increasing, businesses need a better way to stay secure. Cyber warranties fill the gaps left by insurance, providing a stronger, more effective approach to cybersecurity protection.

Also Read: Bridging the Gap: How DLT Can Transform Your Cybersecurity Framework